Sales Tax For All States 2024

Sales Tax For All States 2024. 2024 us sales tax by state, updated frequently. Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and.

Sales tax in the united states is a tax charged on services (by service providers) and products (by retailers) at the point of payment. July 2023 (2 changes) june 2023 (1 change) may 2023 (772 changes) over the past year, there have been 1087 local sales tax rate changes in states, cities, and counties across.

Alaska, Delaware, Guam, Montana, New.

Sales tax is added to the price of taxable goods or services and.

With Respect To Sales Tax, States Are Primarily.

Average sales tax (with local):

As Of January 2024, 45 States, The District Of Columbia, And Puerto Rico Require A Sales Tax On Many Goods And Some Services.

Images References :

Source: www.troutcpa.com

Source: www.troutcpa.com

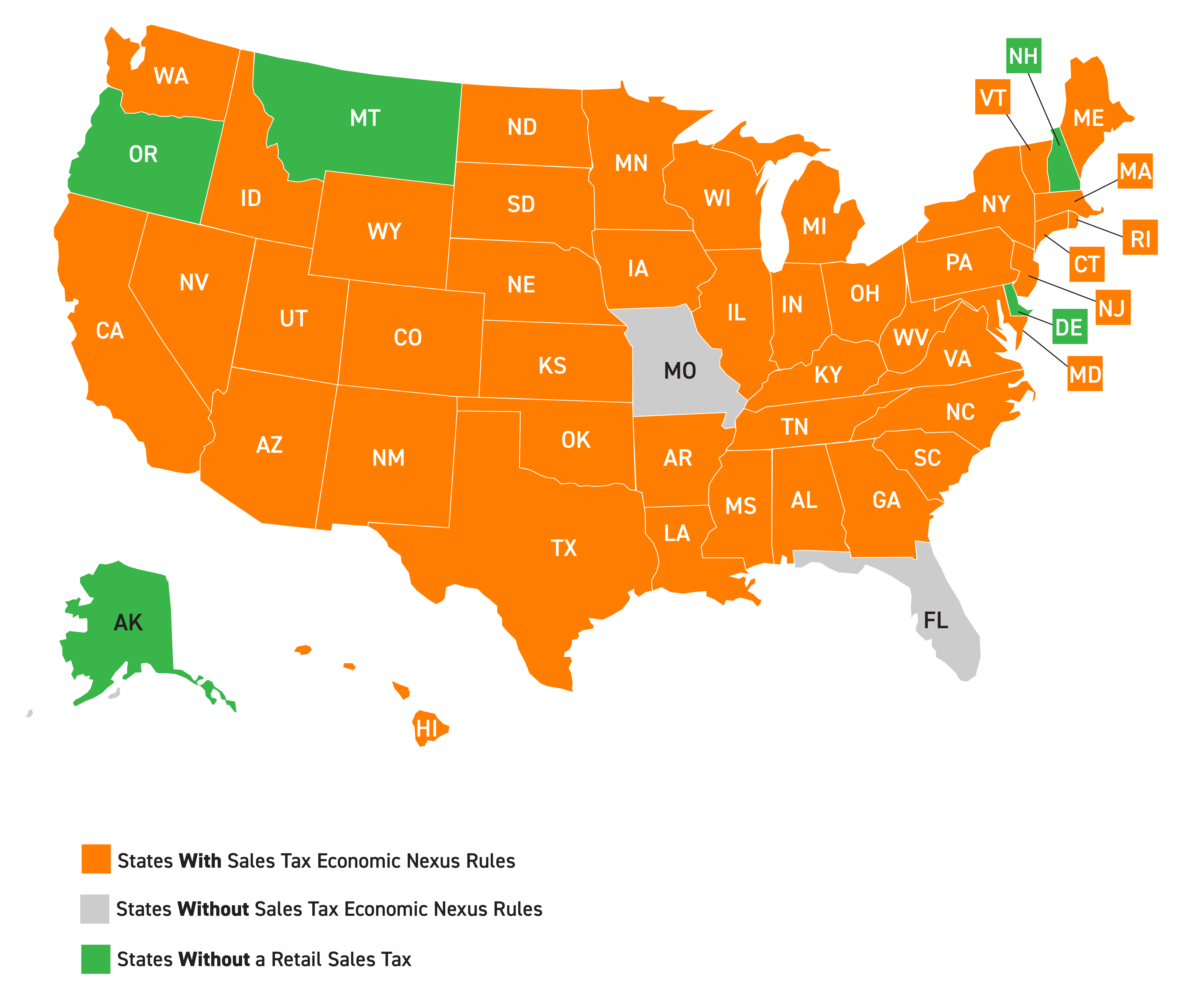

OutofState Sales Tax Compliance is a New Fact of Life for Small, Of these states, they split pretty equally. Wolters kluwer provides an overview of the general sales taxes rates across all 50 states and the district of columbia.

Source: taxfoundation.org

Source: taxfoundation.org

2023 State Tax Rates and Brackets Tax Foundation, Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and. The sales tax rates across states vary significantly, with california, at 7.3%, holding the highest sales tax rate.

Source: www.m3wealth.com

Source: www.m3wealth.com

Tax Information Financial Planning, Idaho Falls, ID M3Wealth, 2024 list of arizona local sales tax rates. United states sales tax for 2024/25.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, Sales tax in the united states is a tax charged on services (by service providers) and products (by retailers) at the point of payment. 2024 us sales tax by state, updated frequently.

Source: coolshotfilms.com

Source: coolshotfilms.com

Is texas sales tax recoverable, With respect to sales tax, states are primarily. As of january 2024, 45 states, the district of columbia, and puerto rico require a sales tax on many goods and some services.

Source: taxfoundation.org

Source: taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, Kansas is lowering the sales and use tax rate on food from 4% to 2% starting january 1,. Also, check the sales tax rates in different states of the u.s.

Source: www.pinterest.com

Source: www.pinterest.com

Sales Tax by State Here’s How Much You’re Really Paying Sales tax, 53 rows the following chart lists the standard state level sales and use tax rates (as of 4/1/2024) sales and use tax rates change on a monthly basis. Colorado has a sales tax of.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Sales Tax Laws by State Ultimate Guide for Business Owners, Fast and easy 2024 sales tax tools for businesses and people from the united states. With respect to sales tax, states are primarily.

Source: sovos.com

Source: sovos.com

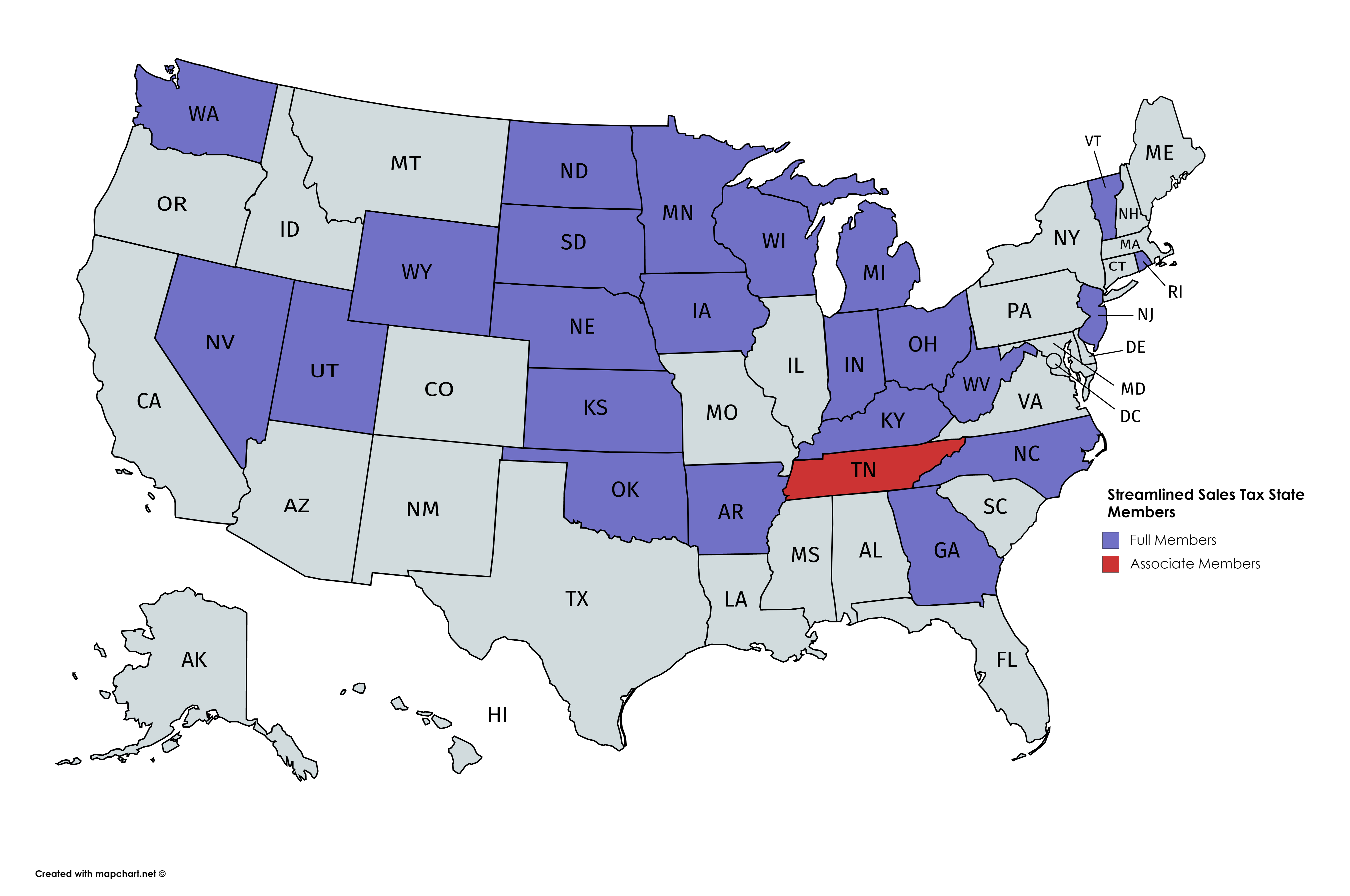

Sovos and the Streamlined Sales Tax Project Fact Sheet Sovos, Fast and easy sales tax tool for businesses and people from the united states. Of these states, they split pretty equally.

Source: wisevoter.com

Source: wisevoter.com

Sales Tax by State 2023 Wisevoter, With respect to sales tax, states are primarily. A sales tax holiday is a time when consumers don’t pay sales tax on eligible purchases of certain normally taxable.

Fast And Easy Sales Tax Tool For Businesses And People From The United States.

Also, check the sales tax rates in different states of the u.s.

Rate From 5.125 Percent To 5 Percent In July 2022.

There was a good deal of state tax reform in 2023, for the third consecutive year, and that trend is looking to continue into 2024.